Today, supply chain disruption within global commerce continues to present significant challenges for businesses. Three major geopolitical regions are posing significant challenges for global companies: the Red Sea, Ukraine, and Taiwan.

An intricate web of interconnected processes, myriad stakeholders, and changeable variables – including simmering geopolitical tensions and armed conflict – have made effective supply chain management more critical than ever. Many companies that devised new strategies as a result of the COVID-19 pandemic are now having to implement them far more rapidly than they first envisaged.

Red Sea crisis

Maritime shipping – a cornerstone of international commerce – is currently under pressure from crises enveloping several global trade chokepoints. Primary among these is instability resulting from Houthi attacks on ships in the Gulf of Aden and the Red Sea.

Vital Routes

Nearly 15% of global trade uses the Red Sea-Suez Canal seaway. It represents 30% of the world’s container traffic and involves critical products such as grain, oil, and natural gas. These routes are thus, vital for vessels.

The Houthi attacks, which began in November last year, are the latest fallout from the ongoing Israel-Hamas war. The Shiite rebel group initially claimed they were only attacking Israeli and Israel-bound ships in support of Hamas. Since then, however, they have targeted merchant tankers from multiple countries.

The Houthi utilize advanced equipment like drones and missiles. This prompted reactions from the U.S. and UK militaries, sparking concerns of escalating conflict. So far these retaliatory strikes have failed to put an end to the Houthi hostility.

Re-Rerouting

As a result, many of the world’s largest shipping companies have paused or diverted their operations in the Red Sea. Nearly 500 container vessels were re-routed since late 2023. But this has a cost.

Sending ships around the Cape of Good Hope can add up to 17 days of transit time to journeys. It means up to $1 million in extra fuel for every round trip between Asia and Europe. Besides, insurance costs are rising, adding to the overall cost of shipments.

Excess shipping capacity has helped to soften the blow of the Red Sea crisis. However, shipping rates to send containers from China to the U.S. have increased dramatically. According to online container trading and leasing platform Container xChange, February leasing rates are up almost 300% year-on-year.

For Chris Clowes, senior consultant at global supply chain and logistics consultancy SCALA,

“Between 2021 and 2022, 40-foot container prices from China to Europe and the US reached $15,000, but in 2023, prices dropped significantly to pre-COVID levels of around $2,000. Shipping companies had started to slow-sail and reduce sailings to cope with the supply–demand imbalance. The increased costs are challenging, but businesses have become much more confident and upfront about passing on increased freight prices to consumers and know that this can be planned for.”

Disrupting Shipping Timescales

According to Mr. Clowes, the Red Sea crisis is disrupting shipping timescales. The main concern is the delay in products arriving and the uncertainty around future schedules.

“Not knowing when a product is going to arrive can be extremely challenging and put entire sales plans at risk. As such, we could see more businesses considering near-shoring – sourcing items from closer locations – to boost resilience going forward.”

Ukraine and Grain

In 2023, concerns swirled around potential food shortages as war raged between Ukraine and Russia. The two countries are the world’s largest grain-producing countries. Following the onset of the war, the Russian military blocked Ukraine’s Black Sea ports and brought exports to a virtual standstill. Ukrainian farmers have since abandoned millions of acres of land. Before the war, around 90% of Ukraine’s agricultural exports were transported by sea.

So far, though, the impact of the war on the global grain trade has not been as severe as it was once feared. While lower exports of agricultural commodities from Ukraine continue to contribute to tighter and more volatile global markets, trends in Ukrainian exports are becoming less and less important to global commodity markets. Supply chains are adapting well to the initial disruption.

Agricultural exports from Ukraine, including grain, are also now relying more heavily on overland routes and the unblockaded Ukrainian ports of Reni and Izmail, located on the River Danube. For Chris Clowes,

“In the immediate aftermath of the Russian invasion of Ukraine, wheat prices rose sharply, and export volumes dropped dramatically. But by early to mid-2023, volumes had recovered to between 1.5 and 2 million tonnes a month, and prices were back to – and in some cases below – 2021 levels. This is largely a testament to the will of Ukraine to continue trading, together with added support from Europe and the US.”

Taiwan: The Semiconductor Situation

Today, China is intensifying its military, economic, and diplomatic coercion of Taiwan. For China, Taiwan is a piece of lost territory that must be returned, by force if necessary. While a war between China and the United States over Taiwan is neither imminent nor inevitable, it has the potential to massively disrupt global trade. Because it is largely based on one product – semiconductors.

A Global Shortage?

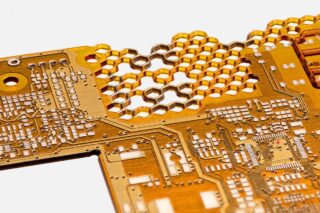

Taiwan’s semiconductor factories are the source of many of the chips used in the world’s computers, servers, and mobile phones. An extended geopolitical conflict could create a global shortage.

This upcoming shortage would significantly exceed the current chip scarcity, which has severely impacted the automotive sector. Estimated to have incurred over $200 billion in losses, the industry faced halted production lines, awaiting semiconductor deliveries delayed by supply chain disruptions from the COVID-19 pandemic.

A Military Intervention?

A Chinese naval blockade of Taiwan, or an outright invasion, would immediately cut off the supply of nearly all current production SoCs. Systems on chips are designed by the likes of Qualcomm, Broadcom, and Nvidia. And they supply them to global multinationals such as Apple, Samsung, Dell, and HP.

For Chris Clowes,

“The semiconductor situation is very different from the challenges we have seen when it comes to the tensions in the Red Sea and Ukrainian exports. Firstly, there is a significant supply and demand imbalance. Taiwan produces around 60% of all semiconductors and chips, with just two manufacturers, TSMC and UMC, accounting for over half of this. The situation is further exacerbated by the growing global demand for semiconductors, which are used in a significant number of products – from smart fridges to vehicles.”

And we have already seen shortages during the pandemic severely impact the delivery timescales of many car and van manufacturers.

“Secondly, there is the increasing risk of military action in the region. Most economists and politicians previously thought all-out war was unlikely. Putin and Russia changed this. If China were to take action in Taiwan, economic sanctions could seriously hinder China’s export market, which accounts for nearly 20% of GDP.”

Eliminating supply-chain risk is nearly impossible for those companies that currently rely on Taiwanese semiconductors. However, they need to understand their risk exposure in the Asia-Pacific region. And they should consider the feasibility of diversifying the number and geographical location of their chip suppliers.

What to Expect From the Next Years?

With ongoing geopolitical crises, stress on the global supply chain looks set to continue throughout 2024, warns Chris Clowes:

“In summary, disruption will continue – which could be especially challenging as we head into an election year in many parts of the world. If consumer confidence starts to drop – even in the face of reducing inflation – businesses will need to assess if they can pass on costs to their customers, or absorb them and reduce their margins. What’s more, the global events of recent years have forced supply chain professionals to adapt continuously, which is already taking its toll on those expected to operate within a constant state of flux. When it comes to those working in procurement, who are often tasked with cutting costs, many professionals are reporting higher levels of stress and burnout. Going forward, the industry needs to work hard to support employees and avoid exacerbating these challenges any further.”

Constant geopolitical tensions, and other challenges, have heightened awareness amongst organizations that supply chain disruptions are becoming increasingly commonplace. A growing number of businesses are now proactively preparing for supply chain risks and disruptions, rather than merely reacting to problems as they occur.

Across the world, they significantly increased their investment in supply chain innovation in 2023. Some have doubled their average spending from the previous year. This year will see a continued increase in the use of digital platforms to increase supply chain visibility, optimize logistics, and enable greater adaptability and responsiveness.

We can also expect to see a rise in near-shoring in 2024. In addition, smart warehouse automation is becoming increasingly important in supply chain management as a way of boosting resilience.