European industry faces a volatile international trade environment with the entry into force of Trump’s tariffs. In this article, we evaluate the consequences for various industrial sectors—from automotive to tech to industrial goods. We also explore how you, European manufacturers, can navigate these uncertain times and prepapre for what’s ahead.

Turbulent Times

Since he came to office on January 20, US president Donald Trump has signed a plethora of executive orders and policy reversals. Of these actions, one has had a particularly disruptive impact on global markets – the announcement of a wide-ranging “reciprocal” tariff programme.

Trump’s attempt to reset international commerce poses a profound challenge to the global rules-based trading system. It also signals a huge shift after decades of multilateral trade liberalization. While the exact, long-term scale of US-imposed tariffs remains unclear, the macroeconomic impact on European industry could be significant. A whole raft of sectors might be affected in different and multi-faceted ways.

This article breaks down the sector-by-sector fallout of Trump’s tariff regime, explores the lasting ripple effects on transatlantic trade, and offers insights into how European industry leaders can adapt, compete, and future-proof their operations in a new era of economic nationalism.

Automotive Sector

On April 9, President Trump announced a 90-day suspension on most of the reciprocal tariffs on imports he had announced the previous week (20% on imports from the EU, and 10% on imports from the UK), although the majority of EU goods sold into the US are still subject to a baseline 10% tariff. This suspension also excludes a 25% tariff on cars and car parts imported into the US, which came into effect for completely built up (CBU) vehicles on April 3, and will come into affect for car parts on May 3.

Trump’s tariffs are widely expected to have a negative impact on the European automotive industry. The sector is already grappling with a broader slowdown in consumer spending and intense electric vehicle competition from China. This could potentially lead to higher costs, reduced demand, and sweeping supply chain disruption.

While some manufacturers may be able to absorb some of these additional costs, the long-term effects could be dramatic, including potential layoffs and factory closures. Car manufacturers such as BMW, Volkswagen, and Mercedes, which have a strong presence in the US market, are already feeling the tariff impact more severely. Indeed, Germany accounts for nearly 65% of the EU’s vehicle exports.

For Nick Bulters, CEO at leading, Amsterdam-based international trade consultancy CATTS,

“The automotive sectors in the EU and the UK are dealing with higher input costs due to global price increases in steel, aluminium, and other critical components. US tariffs have already shifted trade flows, with Asian and US carmakers redirecting inventory to Europe and the UK, intensifying price competition.”

According to him, the real risk lies in unpredictability.

“Imagine shipping 6,000 vehicles worth US$180 million to the US, only to face a 25% tariff imposed mid-transit. That’s US$45 million in unexpected costs. This scenario isn’t theoretical – it’s the kind of disruption some exporters are facing. Tariff uncertainty affects pricing, forecasting, and competitiveness, with limited options for quick course correction. Set against the volatility we’ve seen over the past weeks, strategic planning for European carmakers looks more like gambling right now.”

Curious about how the EV sector is coping? Don’t miss our in-depth look at the challenges facing electric vehicle manufacturers.

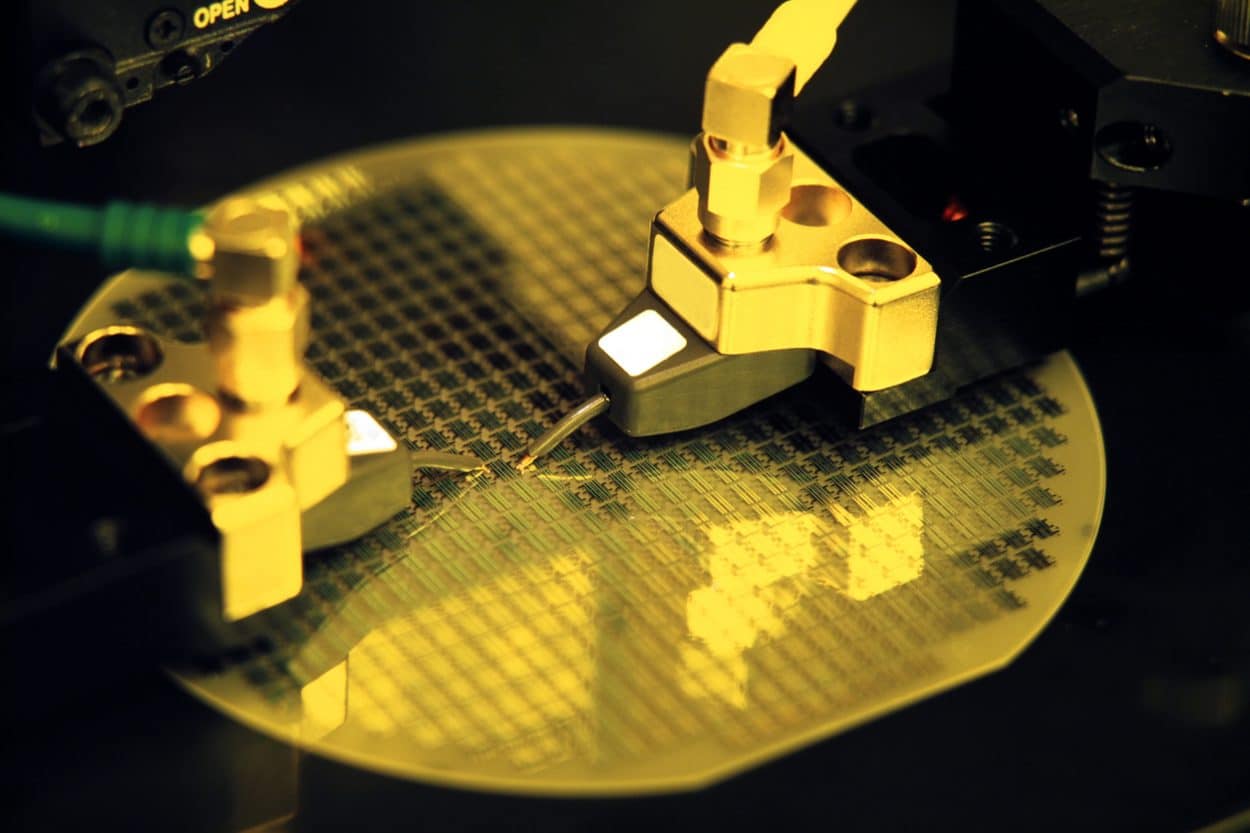

Technology

While the pause on reciprocal tariffs has provided some immediate relief for the European technology sector, the baseline 10% tariff that went into effect on April 5 remains in place. Together with tariffs on China (which now stand at a gargantuan 145%) and general market uncertainty, the current tariff situation continues to have significant ramifications, with the potential to ramp up manufacturing costs and disrupt supply chains.

EU tech sub-sectors – particularly electronics and industrial automation – depend on complex, globally integrated supply chains. Long-standing US tariffs on Chinese semiconductors and components have already forced many EU companies to shift sourcing, leading to longer lead times and higher costs.

Even the baseline tariff imposed in April could materially affect the ability of European hardware manufacturers to trade in the US. Telecoms hardware providers such as Ericsson and Nokia, increasingly reliant on US operators, may be particularly exposed. While semiconductors have so far escaped targeted US tariffs, Trump has hinted that specific chip-focused tariffs will arrive soon. End products (such as cars and consumer electronics) containing chips are already being hit by tariffs, effectively impacting the entire industry, while the cost of European-manufactured machines used to produce semiconductors could also rise considerably, impacting US sales.

The US recently indicated that some fully assembled electronics may be exempt from import duties, which is an interesting move. But for Nick Bulters,

“Technology is a major US export to the EU and UK, so this exemption might be aimed at reducing the risk of retaliation from close partners. However, it also creates a mixed message. While the broader policy push is toward moving manufacturing and assembly back to the US, exempting finished products may actually discourage companies from relocating their assembly lines.”

At the same time, he believes UK and EU firms could see both opportunity and complexity;

“There may be some benefit from reshoring or regional diversification, but compliance, origin rules, and digital trade governance are becoming harder to manage. Uncertainty around these issues is now a regular part of planning in the sector.”

Consumer Products

Should higher tariffs be reimposed after the current pause, the EU’s consumer product industries face a potential loss of competitiveness due to an increase in final costs, risking production slowdowns and job cuts if US consumers turn to other markets – or an accumulation in unsold inventory. Many consumer products are part of global supply chains, which are also facing widespread disruption. In addition, cheap products manufactured in China may be redirected to European markets, Nick Bulters predicts:

“In consumer electronics, textiles, and appliances, UK and EU retailers may temporarily benefit from diverted stock originally intended for the US market. However, local manufacturers are under pressure. These redirected goods often arrive with aggressive pricing, creating a challenging environment for domestic production. Uncertainty in global sourcing has also impacted planning for seasonal demand and inventory management.”

Healthcare and Pharmaceuticals

In 2024, the European Union’s collective economy exported €582.5 billion worth of goods to the United States. The largest single sector in this figure was the pharmaceutical industry, which sent €122.1 billion in products and materials across the Atlantic.

While reciprocal tariffs appear to have excluded pharmaceuticals so far, pharmaceutical-specific tariffs look to be a question of when, not if. While the industry hopes to convince the US administration that tariffs on pharmaceutical imports will be majorly disruptive – given the complex and intertwined nature of supply chains stretching across the Atlantic – Trump has repeatedly threatened tariffs targeting medicines.

The threat of import duties has already spurred drugmakers to accelerate shipments to the US and warehouse supplies, which will protect their 2025 financial outlooks and take the pressure off any immediate price increases.

“Tariffs on inputs such as packaging, chemicals, and specialized components are already pushing up costs for EU and UK-based pharmaceutical and medical device companies,” says Nick Bulters. “Multinational firms have started to reroute supply chains, sometimes prioritizing tariff-neutral regions. These shifts can lead to delays or increased procurement costs. The impact is especially clear in logistics, sourcing, and investment planning.”

Industrial Goods

European exports to the US are dominated by medicinal and pharmaceutical products, followed by mechanical and industrial machinery, automotive and transport equipment, and electronic and electrical equipment and machinery. While the EU has offered the US zero-for-zero tariffs for all industrial goods, this proposal has already been rejected. On March 1, the US imposed 25% tariffs on imports of industrial-grade steel, aluminium, and derivative products, and these continue, despite the pause in reciprocal tariffs. The European machinery sector could face significant negative impacts if and when tariffs resume, which could lead to higher prices for EU-made machinery in the US market and lower demand.

“Manufacturers of machinery, tools, and components across the UK and EU are facing pricing pressure from both ends,” says Nick Bulters. “Companies exporting to the US must manage new cost structures and tighter margins. Many are already adjusting production forecasts and sourcing strategies to manage volatility.”

For Rory Farquharson, Global Head of Manufacturing at UK-based management consultancy Elixirr,

“Trump’s tariffs have caught the manufacturing industry by surprise and will have an immediate impact on short-term earnings forecasts if they go ahead. In the long-term, European manufacturers must quickly adapt by investing to become more nimble and operationally efficient – so expect to hear and see even more around AI and robotic process automation.”

How Can European Businesses Minimize Their Exposure to These Threats?

The historic imposition of tariffs has shown that price increases on imported goods will impact both businesses and consumers. These pressures mean that inflation is once again likely to rise in both the US and EU, reducing economic growth and global competitiveness. So how can European businesses minimize their exposure to these threats?

The first step for companies across industrial sectors is to understand their level of risk. This will enable them to identify vulnerable goods within their portfolio and compare their risk exposure with that of key competitors, offering valuable strategic insights.

“Once they have done this, there are a variety of measures open to businesses looking to develop and implement risk mitigation strategies,” says Nick Bulters. “One or all of the following measures may be applicable.”

Here are 6 measures organizations should try to implement right now.

1/ Diversify Suppliers

Shift sourcing away from tariff-heavy routes. Many manufacturers are building redundancy with suppliers in Southeast Asia, Mexico, or within the UK/EU to reduce exposure.

2/ Optimize Product Classification

Review and validate customs tariff codes and product valuations. Misclassification can lead to overpayment or penalties – both of which can be avoided with proper governance.

3/ Leverage Free Trade Agreements

Explore eligibility under free trade agreements, such as those with Japan, Canada, Vietnam, and Mexico. Suppliers must provide valid origin documentation, so it’s important to audit this regularly.

4/ Make Use of Customs Warehousing and Free Zones

Using bonded warehousing or free trade zones allows companies to defer duties and gain flexibility, especially useful when rerouting or holding goods in transit.

5/ Use Digital Trade Tools With Simulation Features

Modern trade compliance platforms, such as CATTS’ EPOS™ suite, allow companies to digitize customs operations. It can also run “what-if” simulations that consider the following questions: How will costs change if tariffs increase mid-shipment? What are the savings from re-routing through a free trade agreement-eligible country? Is warehousing more cost-effective than clearing at port?

Based in Austria, MIC Customs Solutions is another provider of global customs and trade compliance software. Their cloud-based solutions offer services including automated customs compliance filing and Free Trade Agreement (FTA) management.

“Simulation helps companies stress-test decisions before taking action, which is essential in today’s fast-changing trade environment,” says Nick Bulters.

6/ Engage With Customs Advisors

Early planning is key. Trade experts can identify relief programs like inward processing or duty drawback, and help companies adapt strategies before and during regulation changes.

“We are currently in the 90-day tariff pause window, after which there is a possibility higher tariffs may kick in,” says Nick Bulters.

Now is the time for European companies across industrial sectors to hope for the best outcome, but prepare for the worst.

![Image [Best of 2025] Power Moves in the Energy World](/wp-content/uploads/sites/3/energy-320x213.jpg)

![Image [Best of 2025] How Generative AI Is Transforming Industry](/wp-content/uploads/sites/3/AI-4-320x213.jpg)

![Image [BUYING GUIDE] How to Choose the Right Industrial Robot?](/wp-content/uploads/sites/3/Industrial-Robot-320x213.jpg)

![Image [Buying Guide] How to Choose the Right Safety Shoes?](/wp-content/uploads/sites/3/Safety-Shoes-320x213.jpg)