Four years after the last Paris Air Show at Le Bourget, the aviation industry has changed almost immeasurably. Technologies have accelerated and orders proliferate, even while the supply chain creaks under the pressure —and the industry focuses not only on delivering the aircraft of today but the sustainable aviation future of tomorrow.

Fundamental to the decarbonization challenge for larger aircraft is faster progress towards funding, technological development, industrialization, infrastructure, and production of more sustainable aviation fuels, known as SAF.

A Rare Joint Statement On Sustainable Aviation Fuels From 7 Big Name CTOs

In a rare agreement from companies with varying visions of the decarbonized future, the chief technology officers of seven of aviation’s biggest companies issued a joint statement on sustainable aviation fuels, some two years on from a previous letter focussing on action plans and a wider agenda.

This statement — signed by Sabine Klauke of Airbus, Todd Citron of Boeing, Bruno Stoufflet of Dassault Aviation, Christopher Lorence of GE Aviation, Geoff Hunt of Pratt & Whitney, Grazia Vittadini of Rolls-Royce, and Eric Dalbiès of Safran — is the clearest signal to the market yet of the aviation industry’s need for sustainable aviation fuels, or SAFs.

The CTOs welcomed specifically “government policies and initiatives that stimulate investment in production capacity, reduce costs, and encourage greater industry uptake.”

Welcoming the US Inflation Reduction Act of 2022 (IRA), its blender’s tax credit — and the funding for SAF production, distribution, infrastructure, and technology — the CTOs also highlighted the benefits of developing projects for fuel-efficient aircraft and other ways of reducing emissions.

Notably, they called for public-private partnerships (noting specifically the FAA FAST Tech Program), which they said would “enhance OEM adoption, testing, and technical clearance of new emerging SAF pathways to ensure seamless insertion into the commercial fleet.”

Across the Atlantic, the ReFuelEU Aviation agreement and the signal it sends to the market for SAF production came in for support, as did the Net Zero Industry Act and the Industrial Alliance for Renewable and Low Carbon Fuels (RLCF).

In addition, “qualification efforts that support the development of co-processing technologies that can harness the existing capital infrastructure will accelerate the availability of SAF at commercial scale,” the CTOs noted.

Lastly, the CTOs highlighted that “policymakers have the chance to accelerate these processes by providing sustained and predictable support to the multi-year development of novel technologies, and by stimulating the ramp-up of capacity,” and noted that “recognizing the technical challenges associated with decarbonizing aviation, greater public policy and financial support to accelerate SAF production and distribution over fuels used for surface transportation is essential.”

Big Orders Sound A Warning for the Supply Chain

The record-breaking 500-aircraft order for Airbus A320neo family aircraft by Indian airline IndiGo stunned with its size but also raised bigger questions about production and the supply chain.

With the delivery of all aircraft planned over a five-year period from 2030 to 2035, the pace of delivery —which works out at some 8 to 9 aircraft per month over that period —is as unusual as the sheer size of the order. At present, Airbus is well below its post-pandemic production goals, presently around the 50 per month mark, with an aim of 75 per month by the middle of the decade.

The entire supply chain of the Airbus aircraft involves multiple components and stages. Starting from the Airbus final assembly lines, which are already operating at maximum capacity and have expanded with the addition of a new line in Tianjin, China. However, there are ongoing challenges with engine production and reliability for Pratt & Whitney’s PW1000G geared turbofan engines, which are installed on nearly half of the A320neo family fleet. Additionally, the CFM Leap-1A engines also face some reliability and removals supply issues, albeit to a lesser but still significant extent. These challenges extend beyond the engine makers and affect other segments of the airliner supply chain, including seat makers and various other parts suppliers.

Airbus Branches Out Its Hydrogen Focus To APUs

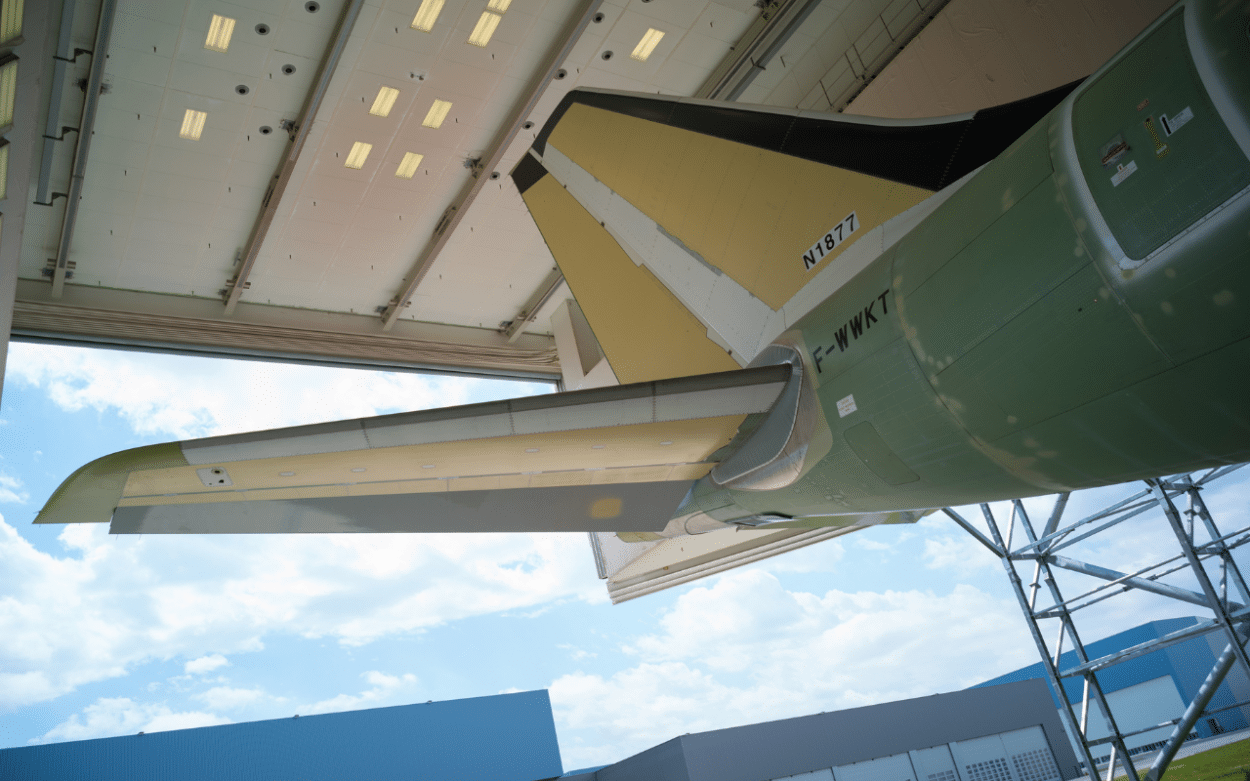

Few outside the aviation industry know of the extra engine aboard every airliner: the Auxiliary Power Unit, or APU. Airbus, as the primary airframer focussing on the research and development of hydrogen power for commercial flight, is now including the APU in its research with a new test project called HyPower.

HyPower consists of a hydrogen fuel cell system, situated in the usual APU location in the tail of the A330 test aircraft, fed by hydrogen tanks within the aircraft’s body, and providing power to the aircraft’s systems.

For Michael Augello, chief executive officer of Airbus’ tech demonstrator hub UpNext, the HyPower tests

“will mark a new step in our decarbonization journey and ZEROe program through an ambitious flight demonstration that will take to the air by the end of 2025. We want to demonstrate the operability and integration of the system, including refueling the aircraft with hydrogen. We will demonstrate this system in realistic conditions, climbing to 25,000 ft and flying for one hour with 10kg of gaseous hydrogen on board.”

Current and Future Sub- 20-Seater Aircraft See A Strong Focus, But Vaporware Questions Remain

The sub-20-seater market is making waves at the 2023 Paris Air Show, both in terms of the expected eVTOL, air taxi, and advanced air mobility segments and in a less expected — but also substantially more tangible — relaunch of the venerable DHC-6 Twin Otter 19-seater by De Havilland Canada, now in its fifth generation.

DHC chief executive officer Brian Chafe said

“With the same rugged airframe, propelled by Pratt & Whitney technology, the lighter weight Classic 300-G will deliver increased payload range and decreased operating costs for our customers.”

He also noted that the aircraft comes with

“an all-new cabin interior and flight deck featuring the Garmin G1000 NXi fully integrated avionics suite.”

Elsewhere, the buzz continues to build around the next generation in this market including Boeing’s Wisk, Embraer’s Eve, Lilium, Volocopter, Archer, eHang, AURA AERO, and more. Orders are many — Eve secured 30 from Nordic Aviation Capital and a further 50 via its Widerøe Zero incubator partnership with Widerøe — but regulatory, safety, and technological barriers (as well as perennial questions around funding, mergers, and acquisitions) mean that this is still a bleeding-edge rather than leading-edge part of the industry.

![Image [Best of 2025] Power Moves in the Energy World](/wp-content/uploads/sites/3/energy-320x213.jpg)

![Image [Best of 2025] How Generative AI Is Transforming Industry](/wp-content/uploads/sites/3/AI-4-320x213.jpg)

![Image [BUYING GUIDE] How to Choose the Right Industrial Robot?](/wp-content/uploads/sites/3/Industrial-Robot-320x213.jpg)

![Image [Buying Guide] How to Choose the Right Safety Shoes?](/wp-content/uploads/sites/3/Safety-Shoes-320x213.jpg)