What are the electronics trends in the years to come? With the war in Ukraine and the US-China tensions over Taiwan, the electronics industry is facing many challenges. But there are some reasons to be cheerful. Harpreet Singh from consulting firm L.E.K. gave us more insights.

Today, the electronics industry is one of the largest global industries. It has shown positive expansion since mid-2020 and will continue to experience accelerated growth over the medium to long term, with a forecast value of $790 billion by 2030.

Demand has been boosted by a variety of macro drivers, such as the ongoing penetration of smartphones in emerging markets, the Covid-accelerated rise of e-learning, home entertainment, and home automation, the proliferation of digital use cases in industrial environments (e.g. robotics and smart factories), the electrification and electronification of mobility, and improvements in telecom infrastructure (e.g. 5G).

Despite this generally positive outlook, however, short-term challenges to growth persist. According to Harpreet Singh, a London-based partner in the Industrials practice of global strategy consulting firm L.E.K.

“Supply chain constraints in the electronics industry have been significant, particularly around semiconductor chips. These began with accelerated demand during the Covid-19 pandemic and were compounded by constrained capacity in China and other Asian countries, severe weather in Taiwan in 2021, and the Russia-Ukraine war, with Russia a key supplier of materials such as palladium. Other factors such as the inflationary environment, geo-political tensions (US-China and China-Taiwan), decreasing consumer confidence, and labour shortages have all been problematic.”

Reasons to Be Cheerful

Going forwards, improving supply-demand dynamics should offer some respite from many of these challenges. Lead times for semiconductors have been shrinking since September 2022, inventory levels are increasing, and manufacturers are back at high levels of capacity utilization. The Covid-19 demand spike has started to normalize, significant investments have been made to enhance the production capacity, and new players are starting to emerge, says Harpreet Singh:

“I anticipate 2023 to be a softer year from a demand perspective, as the global economy deals with a difficult macro-economic environment. This, combined with increasing electronics supply, is likely to pave the way for a more balanced market and a stronger medium-term outlook from 2024 onwards.”

Europe on the Rise

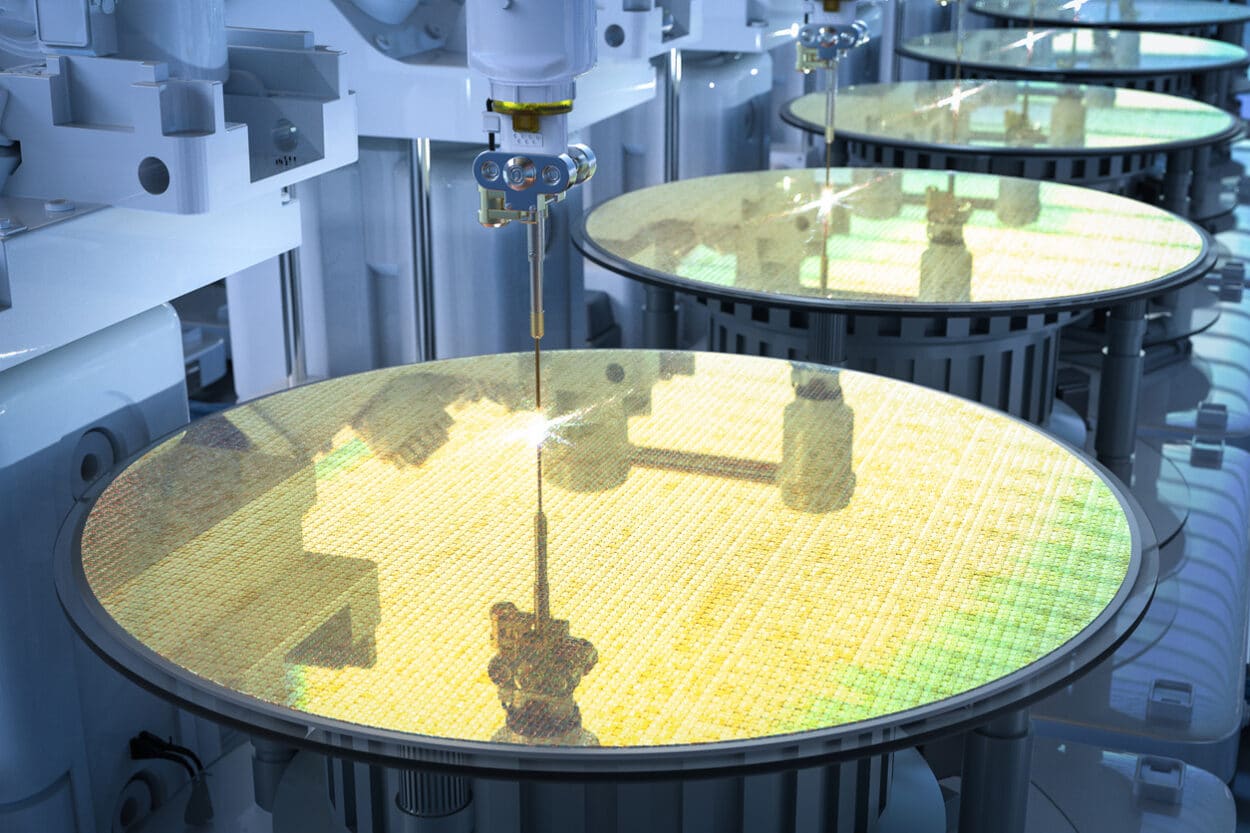

For years, the global semiconductor market has been dependent on Asia, with almost two-thirds of chips manufactured there, particularly in Taiwan, China, and South Korea. The disruption of recent years has made European manufacturers realize that more autonomy is necessary to combat the shortage.

The European Chips Act, which was announced in February 2022, will see €43 billion made available up to 2027 to develop a European semiconductor ecosystem. The act is focused on building capacity for next-generation chip technologies, enhancing supply security, and preparing for possible future supply crises. It follows in the footsteps of similar investments announced by other countries and regions – most notably the CHIPS and Science Act in the US – which has comparable objectives and will provide an estimated $280 billion.

For Harpreet Singh,

“The act will help consolidate existing R&D programmes (e.g. Horizon Europe and Digital Europe), encourage cooperation among firms of different sizes, and increase fabrication capacity in a critical global industry, thereby elevating Europe’s strategic importance. However, building fabrication capacity will be a risky endeavour, particularly as more advanced chips are currently only being manufactured by TSMC, Samsung and Intel. It will be expensive and require a highly skilled workforce. Funding sources and instruments require further specification and clarity. The EU will be joining a global subsidy race, in a smaller way compared to other countries, and there is a risk of overcapacity in the industry.”

Ultimately, it will be difficult for Europe to gain full autonomy, as it will need to rely on other regions for mature chips, input materials (e.g. rare earth metals), and end-market demand.

A Complex Global Playing Field

Several countries are strategically focusing on electronics/semiconductor manufacturing as a way of de-risking their supply from China and Taiwan, as well as enhancing their own geopolitical strength. The US, South Korea, Japan, and India have all announced large-scale investment programs, tax benefits, and specific programs to expand their manufacturing footprint.

“The sophistication of the electronics industry, the quality of talent required, and the supplier concentration at different points of the value chain (e.g. TSMC, Intel and Samsung for fabrication; ASML for lithography), make these endeavors highly complex to execute. It will take several years for capacity to come online and eventually the risk of overcapacity and over-protectionism will need to be managed proactively at a global level.”

Technological Innovation

The electronics industry will continue to thrive over the next five to 10 years and beyond, as an array of technological trends play out.

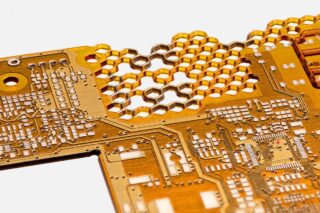

“In terms of hardware innovation, I expect to see continuous enhancement of chip complexity (<1.5 nm nodes). This will require advances in semiconductor manufacturing processes (e.g. matchless plasma) and continue to push the boundaries of precision engineering and testing. There will be further innovation in advanced materials, such as graphene and gallium nitride, to increase the performance and functionality of electronic devices.”

Harpreet Singh also expects to see higher demand for more sustainable electronics,

“with a focus on circular economy and greener materials, large-volume usage of additive manufacturing, use of AI and virtual testing to improve efficiency and push electronics manufacturing innovation, and microchip and AI-driven new electronics use cases across healthcare, mobility, robotics, and energy markets.”