Heading into 2025, the US manufacturing economy appeared to be exiting a period of ‘wait and see’. The US presidential election had been decided, inflation appeared to be coming down, and subsequent interest rate cuts were expected. Prior to President Trump’s tariffs, we were confident that US industrial automation markets would show moderate growth in 2025. However, it appears that the ‘wait and see’ period has been extended by Trump’s broad sweeping tariffs. What looked to be a recovery year for industrial automation suppliers following a down market in 2024 no longer looks certain.

US manufacturing had good momentum heading into 2025 but that has likely changed

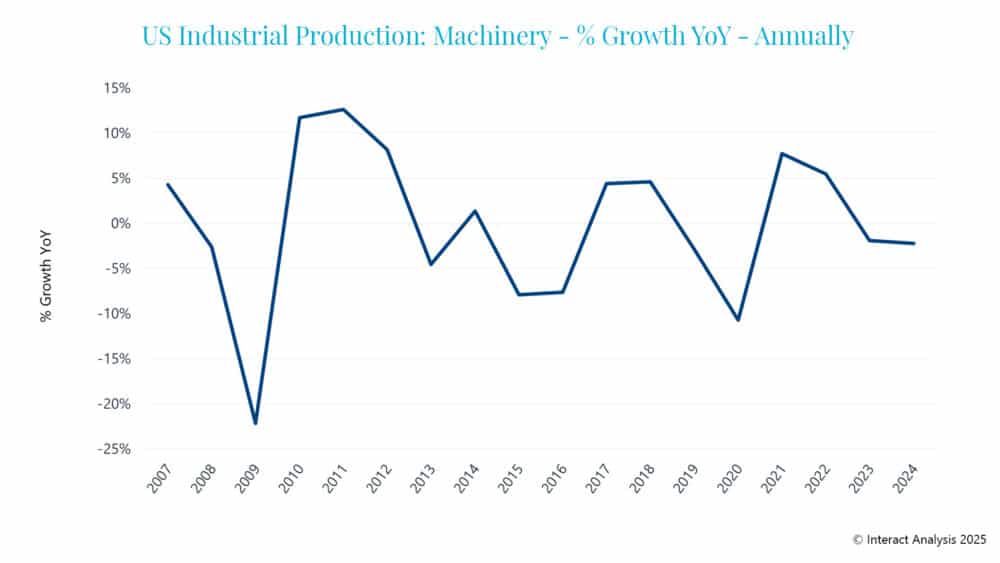

2024 was a challenging year for industrial automation markets . Globally, motion control and low voltage motor drive revenues were down by -7% and -5% respectively – a correction from the rapid growth seen between 2021 and 2023. The decline can be largely attributed to inventory correction by channel partners and customers. In short, overbuying in 2021 and 2022 led to inflated inventories, which needed to be wound down, negatively impacting new orders for automation suppliers. In the US, this was compounded by a contraction in machinery production, further dampening underlying demand.

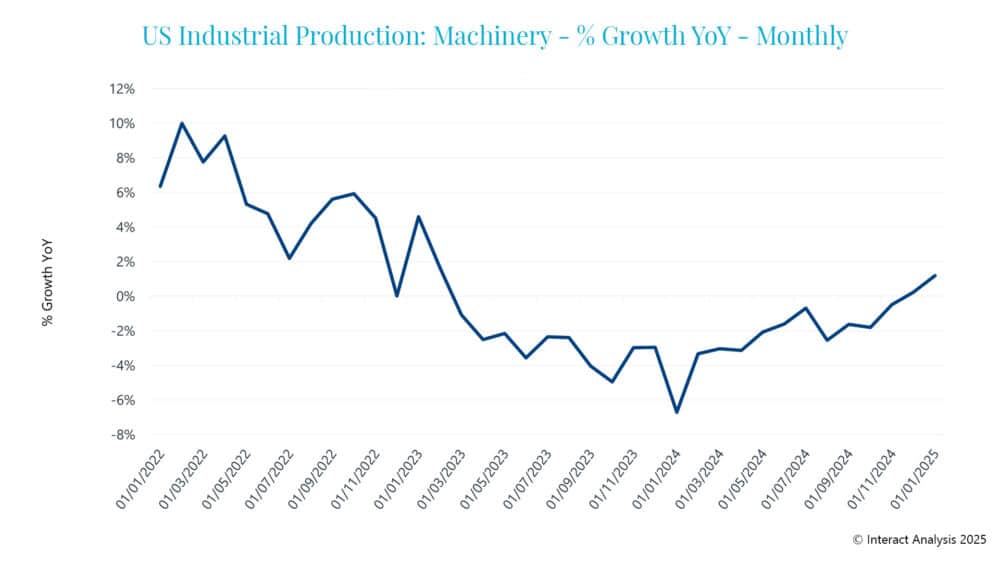

The above graph shows the contraction in machinery production in 2024. For industrial automation suppliers, 2024 marked one of the worst years in recent memory in terms of revenue declines. However, zooming in on a month-by-month basis, you can clearly see a recovery was beginning to mount in the US.

From February 2024 through to January 2025, we saw a gradual improvement for machinery production in the US. While readings for March are not available yet, this momentum is likely to have faltered amid uncertainty created by Trump’s aggressive tariff policies.

Similarly the Institute for Supply Management’s Manufacturing Purchasing Manager’s Index (PMI) fell below 50 in March 2025, indicating a contraction in the manufacturing economy after remaining above 50 for the two previous months (indicating expansion). This furthers the notion that the US manufacturing momentum has been negatively impacted by tariff uncertainty.

Uncertainty over tariff longevity is plaguing manufacturers’ ability to strategize and stifling capital investment

In discussions with machinery manufacturers, one common theme has been the high level of uncertainty over Trump’s trade policy. Uncertainty exists over both the duration of tariffs, as well as the ultimate targets of them. The high level of uncertainty make it difficult for manufacturers to form long-term strategic plans and has forced budget holders into a ‘wait and see’ position. This will stifle capital investment, which in turn will negatively impact industrial production.

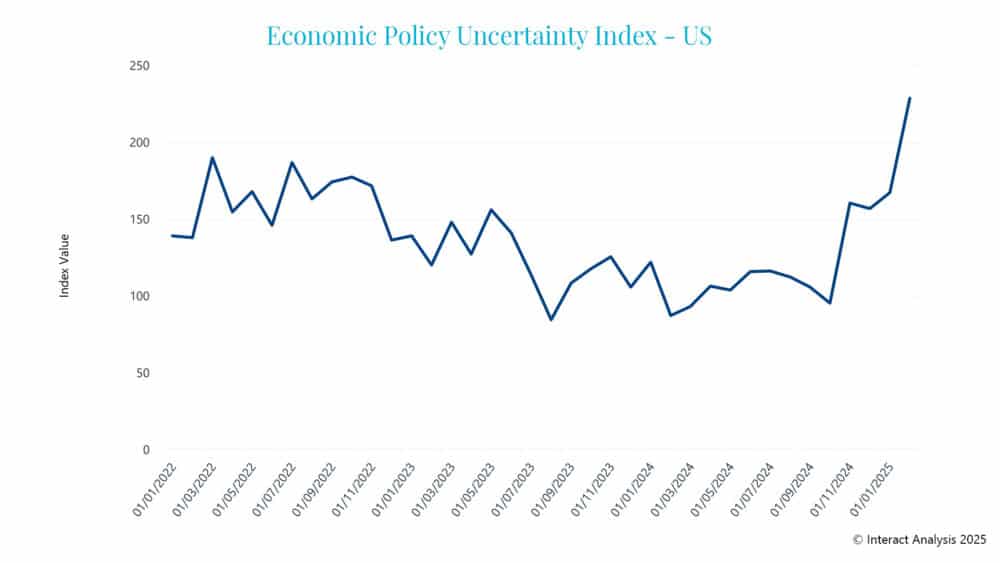

This uncertainty is represented below in a series produced by National Bureau of Economic Research called the Economic Policy Uncertainty Index (EPU).

In a paper documenting the development of its Economic Policy Uncertainty Index, the National Bureau of Economic Research tested the impact of increased uncertainty on industrial production. Its analysis found that a 90-point increase in the EPU Index correlated to a decline from the baseline performance of industrial production of -1.2% at its peak. The degree of impact, however, can be larger and more pronounced if uncertainty continues to climb or becomes volatile.

Over January and February 2025, the EPU index increased 72 points and its safe to assume that it increased further in March and April. With uncertainty spiking, we can expect industrial production to be negatively affected. While this does not necessarily guarantee a contraction for the year, it doesn’t bode well for the prospects of manufacturing growth in 2025.

If the Trump administration was to take a more nuanced approach to trade policy, it could potentially salvage 2025 and we could see slight growth. In our view, however, things seem to be moving in the opposite direction. Trade tensions are increasing, and the Trump administration doesn’t appear willing to alter course without significant concessions. As such, by the time tariff induced uncertainty reduces, the window to recoup the momentum US manufacturing had at the start of the year is likely to have already closed.

![Image [BUYING GUIDE] How to Choose the Right Industrial Robot?](/wp-content/uploads/sites/3/Industrial-Robot-320x213.jpg)

![Image [Buying Guide] How to Choose the Right Safety Shoes?](/wp-content/uploads/sites/3/Safety-Shoes-320x213.jpg)

![Image [Buying Guide] How to Choose the Right AMR?](/wp-content/uploads/sites/3/AMR-320x213.jpg)