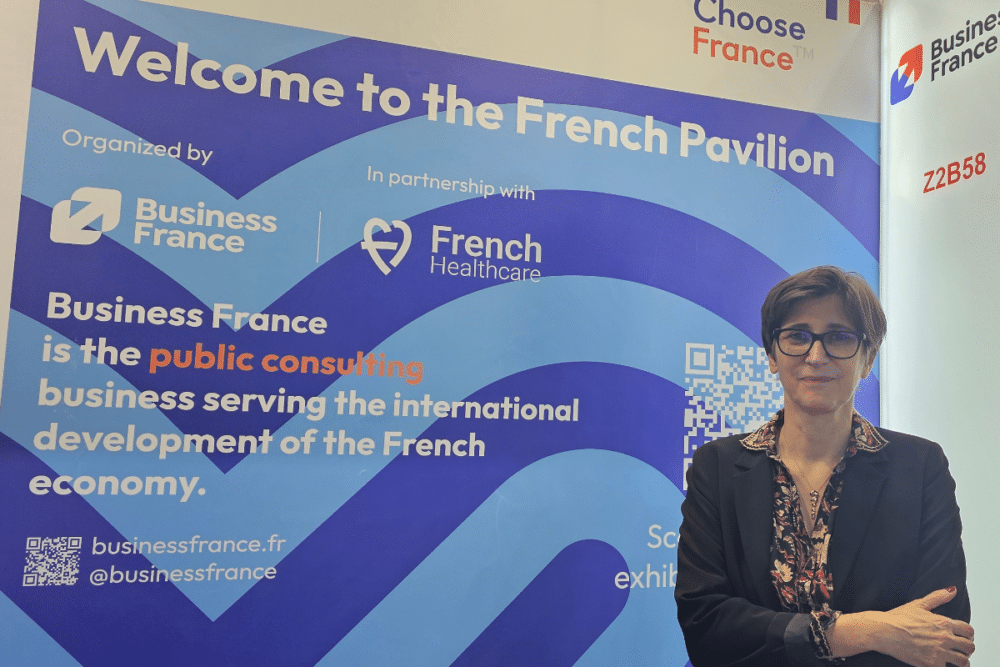

At the Arab Health trade show in Dubai last month, we met with Laurence de Touchet, Director of Export Programs at Business France. We discussed the challenges of French exports in the current geopolitical and economic context, as well as the tools available to the French agency, whose primary mission is to support French businesses abroad. Here is our interview.

Which markets will be the most promising for French companies in 2025, and which sectors have the most opportunities? You are here in the Middle East at Arab Health—this isn’t a coincidence, is it?

Laurence de Touchet: “The Middle East is undeniably one of the key geographic areas for exports in 2025. There is significant interest from businesses, and the activity at Arab Health is clear proof of that. This interest extends beyond the UAE to Saudi Arabia as well. In fact, we had very successful programs at the end of last year, such as the Booster program, where we supported major companies, particularly in Saudi Arabia.

Aside from that, the usual European markets continue to perform well. Germany, despite its recent economic slowdown, remains a key nearby market that attracts many French businesses.

Right after COVID, we noticed that companies were refocusing heavily on Europe—not just the core European markets but also the Nordic countries and Central and Eastern Europe. Now, however, we are seeing a resurgence of long-distance exports, especially to regions like the Middle East and the United States. The U.S. is a particularly strong market with high demand, and this trend is expected to continue, although we are closely monitoring political developments.

As for China, while some companies are still drawn to the market, it is no longer experiencing the boom we once saw.”

In previous interviews with companies you support, many mentioned that Business France guided them toward Saudi Arabia, even though they initially considered the U.S., especially in the medical sector. Do you often see businesses change their target markets based on your recommendations?

Laurence de Touchet: “Yes, that’s exactly our role—to advise businesses in their export strategy.

Some companies come to us with a clear idea of the markets they want to enter because they have already made initial contacts or know that their product has strong potential. Others, however, are unsure.

For these companies, our role is to help them prioritize markets based on their readiness. Expanding into long-distance markets is very different from entering neighboring ones. We take into account factors like the company’s level of maturity, export revenue, product range, market positioning, and competition.

We work closely with our international offices to identify the best opportunities and recommend export strategies tailored to their goals. When companies hesitate, we help them assess the right destinations and guide them toward markets where they have the highest chances of success.”

Given the current geopolitical instability, especially with the tariffs Trump’s administration plans to impose on European businesses, how is Business France adapting? Will you need to adjust your offerings to account for this potential new reality?

Laurence de Touchet: “If this does become the new norm—it’s still early to say—we are closely monitoring the situation. Our U.S. office keeps us informed, and next week, the director of our New York office, who oversees North America, will visit us. He will hold a conference with the head of the North America division at IFRI to analyze how businesses should navigate the new U.S. administration.Many companies have concerns about potential tariffs, but at this stage, we need to see how economic and trade balances will shift and what will actually materialize from the current threats.

Another concern raised by companies and market analysts is the potential instability within the U.S. administration, which could impact how businesses interact with government agencies.

There are many unknowns, and while we cannot predict the future, our North American office is actively working to decipher the situation. Despite the uncertainty, there remains strong business interest in the U.S. market across various sectors. The challenge is to balance this enthusiasm with potential obstacles.

Regarding tariffs, we will have to wait and see.”

READ ALSO

Some analysts suggest that free trade as we know it may be fading. Is there growing interest in strengthening trade relations within Europe?

Laurence de Touchet: “It’s a bit too soon to tell. As an operational agency, we focus on execution rather than policy-making. Economic policies and trade negotiations are handled by government bodies such as the Ministry of Economy and Finance.

If major trends emerge, we will, of course, adjust accordingly. However, for now, we must work within the current framework.”

Are you prioritizing certain industries, such as AI, that show high potential?

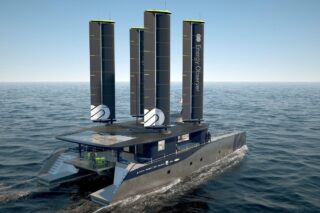

Laurence de Touchet: “We are strongly focused on supporting the winners of the France 2030 initiative, as they represent the cutting edge of French innovation. Key sectors we are emphasizing include artificial intelligence, decarbonization, and advanced medical technologies.

That said, we are a public agency, so we must continue offering export solutions across all industries. However, we may tailor our approach depending on the sector. For France 2030 companies, we aim to provide long-term support through dedicated programs funded by the France 2030 Export plan.”

France is an exporting country, but not at the level of some of our European neighbors. What can be done to help businesses export more?

Laurence de Touchet: “The issue with French exports isn’t just about support programs—it’s also a structural challenge linked to the composition of our economic landscape. As a relatively small export agency, we can’t change this dynamic alone.

That said, we can take targeted action. We’ve moved away from a broad, indiscriminate approach of pushing large numbers of companies into export markets. Instead, we now focus on companies that are more mature, innovative, and have a higher chance of long-term success.

Our strategy is to leverage the excellence of French businesses, particularly small and mid-sized enterprises (SMEs) and mid-sized companies (ETI). We see ETI as a key segment with strong export potential. While there are only about 6,000 ETI in France, they represent the most fertile ground for sustainable international expansion.

This doesn’t mean we’re neglecting other companies, but ETI will be a primary focus as we strive to become the export agency for mid-sized companies.”

Do you have specific export programs dedicated to ETI?

Laurence de Touchet: “We are currently developing a program for ETI, but it’s not yet finalized.. Due to financial constraints, we don’t know what resources will be available for a large-scale initiative.

For now, we are structuring an internal approach to create a dedicated pathway for ETI. This includes identifying them, supporting them, and tailoring specific export solutions to meet their long-term needs.”

Have you already identified the companies that will be part of this initiative?

Laurence de Touchet: “Yes. Our commercial division, along with our regional international business advisors, is actively identifying and compiling a list of ETI that we aim to support.”

Which geographic markets will you prioritize?

Laurence de Touchet: “There is no single target region, as our approach is highly sector-driven. That said, key export destinations remain the United States, Germany, and the Middle East, which continue to attract strong interest. However, Africa also holds significant potential, depending on the industry. Our goal is to match businesses with the right markets based on their sector and growth strategy.”

Are you actively seeking new export destinations?

Laurence de Touchet: “We are not necessarily looking for new destinations. However, we operate in 53 countries through our offices, covering 90% of the global economy. There are some markets we do not cover, but we don’t always seek to expand into them.

Instead, we conduct an annual assessment through our international offices to identify market interest and opportunities. These insights are then cross-referenced with the demand for French offerings.

For example, just because one of our offices reports strong opportunities in the medical sector—perhaps due to hospital construction—doesn’t mean French companies are ready or able to meet that demand.

We must align feedback from our local offices with input from sectoral ecosystems, industry federations, and professional associations. A market only becomes attractive if there is both demand and a strong French supply, with businesses prepared to enter.”

What feedback are you receiving from trade shows? In January, you were at CES, a major U.S. event, and now you’re at Arab Health.

Laurence de Touchet: “My role at trade shows is to gauge the sentiment of both the exhibitors and the overall event. We organize around 110 French pavilions at national and international trade shows across all sectors.

Some events, like Germany’s industrial fairs, Middle Eastern expos, and major U.S. events like CES, remain essential. However, trends are shifting.

With the current economic climate, we’ve noticed certain German trade shows are losing momentum—there are fewer visitors, and some companies are less satisfied. While the quality of interactions remains decent, regional variations exist.

This means we must adapt. It’s not about abandoning these fairs, but rather optimizing resources. That could mean reducing our footprint at certain events and expanding at others—like Arab Health, where demand is high. Here in Dubai, we’re looking to secure more exhibition space to support additional businesses.

Additionally, we aim to allocate resources for more specialized, niche trade shows that align with promising French industries.”

How does the first day of Arab Health feel so far?

Laurence de Touchet: “There’s a strong buzz and high attendance. However, high foot traffic doesn’t always translate to quality leads. We’ll analyze this throughout the event.

At the end of the show, we typically gather exhibitor feedback to determine whether they had meaningful business interactions. The true impact, of course, will only be clear in a few months when we assess actual business outcomes.

For us, trade shows serve two main purposes: First, showcasing France’s attractiveness on the international stage—ensuring strong national representation. And second, helping companies drive revenue—some exhibitors attend to meet distributors and increase visibility, while others are focused on direct sales growth.

Each company has different objectives, and our role is to support them in maximizing their success.”

Your organization launched a marketplace. How is e-export evolving?

Laurence de Touchet: “We are strongly encouraging French businesses to embrace e-export and establish a digital presence. We actively promote this through the Business France marketplace, which we developed, as well as through partnerships with other established online platforms.

For companies with limited budgets that can’t afford to attend trade shows or undertake missions abroad—or for those still determining the right markets—being present on a marketplace offers a valuable way to test international demand.

Our marketplace is free and particularly beneficial for businesses that are not yet fully mature for export. Through this online catalog, companies can gauge buyer interest from different markets and see if their product aligns with international demand before committing further resources.

We believe French businesses must integrate e-export into their strategy, as it serves as a crucial first step, especially for reaching distant markets.”

What advice would you give to a company starting its export journey? Has the approach changed over time?

Laurence de Touchet: “One constant recommendation is seeking the right guidance to avoid pitfalls. With our presence in 50+ international markets, our teams help businesses find the right partners and contacts—the key to export success. That has not changed.

What has evolved, however, is the need for instant communication and responsiveness. Many companies still struggle with timely follow-ups after trade shows or initial business contacts. Some misjudge their capacity to respond to inquiries and end up missing opportunities.

Today, delayed responses are a dealbreaker. Companies must be proactive and react immediately, or they risk losing business.”

Are digital communication tools like WhatsApp changing how deals are made?

Laurence de Touchet: “Yes, absolutely. Instant messaging platforms like WhatsApp are now key business tools in many countries, including Saudi Arabia. We integrate these trends into our preparatory training sessions and webinars for companies attending trade shows or entering new markets.

The shift toward less formal communication does not diminish professionalism—it enhances accessibility and responsiveness. Companies must adapt to this trend to remain competitive.”

Is exporting harder today than it was 15–20 years ago?

Laurence de Touchet: “Not necessarily. The market is more competitive, but the challenges remain the same: having the right product, innovation, market intelligence, and support network.

What has changed is that exporting is now more essential than ever. Given economic challenges in Germany and France, some businesses might hesitate to expand internationally. However, we believe the opposite is true—companies must seek growth outside of France and Europe.

At Business France, our role is to help businesses take that step. French companies have a real opportunity to claim market share abroad, and we must ensure they seize it.”

![Image [Buying Guide] How to Choose the Right AMR?](/wp-content/uploads/sites/3/AMR-320x213.jpg)