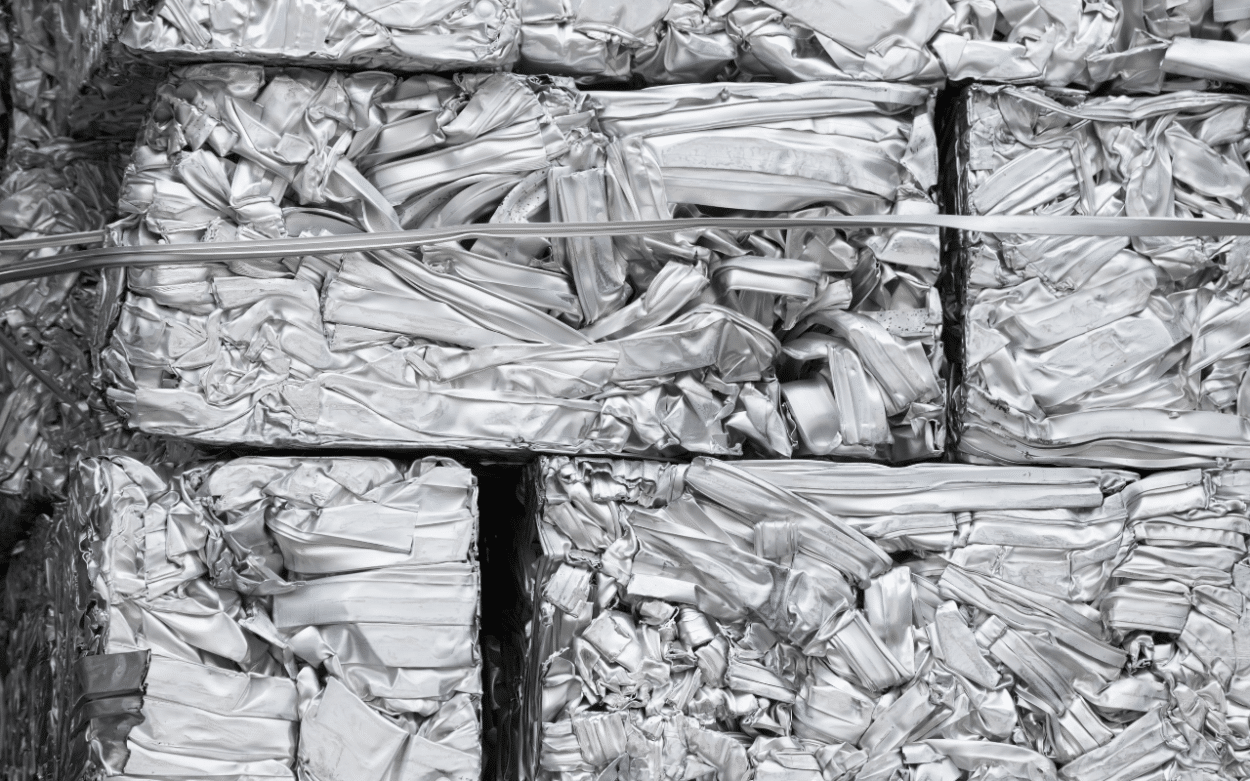

The EU’s electric vehicle market is growing, but relying too much on imports from outside the EU and increasing costs could slow it down. To support its electric car industry, experts in the EU are seeing how to recycle scrap metal such as aluminium as part of a circular economy approach.

Anna E. Frank contributed to this report.

Europe’s aluminium market is feeling a squeeze. In March 2023, the European Commission launched the Critical Raw Materials Act to counter the aftermath of the Covid-19 pandemic and the energy crisis following Russia’s invasion of Ukraine. Aluminium is chief among these critical raw materials (CRMs) because it’s vital to build the continent’s lightweight electric vehicles.

The Demand is Rising

Aluminium demand is also rising. In 2021 the European Union already consumed around 7 million metric tons of aluminium, and demand for it is likely to rise following global trends. The most recent Mobility Consumer Index shows that over 50% of consumers intend to purchase electric or hybrid vehicles.

For Patrik Ragnarsson, Director of Mobility and Strategic Projects at European Aluminium, the voice of the European Aluminium industry,

“The gross aluminium demand is projected to grow by almost 2 million tons between now and 2030. That’s a big change that the industry needs to be prepared for. And hopefully, most of this will come from European production, which is more sustainable than importing from other regions.”

Developing Car Components in Aluminium

He was speaking at a recent seminar ‘The Circular Metal for Future Mobility’, held last month as part of the EU-funded SALEMA project. Their goal is to pioneer innovative aluminium alloys tailored for the automotive sector by developing car component prototypes. The seminar brought experts together to discuss their research developments in aluminium and advanced materials.

Fortunately, aluminium is almost 100% recyclable and requires only 5% of the energy needed to produce the metal from scratch from bauxite ore. However, researchers know well the challenges of reusing aluminium in the automotive industry. There is a need for research into new alloys, for example, using the unavoidable impurities that can accumulate in recycled aluminium, such as iron or magnesium. Their mechanical properties, as does their application, need to be tested, explained SALEMA coordinator Manel da Silva López of the Eurecat Technology Centre of Catalonia.

“SALEMA is developing a non-CRM dependent aluminium ecosystem by substituting the elements that are considered critical raw materials or decreasing their amount in aluminium alloys, and by harvesting these CRM elements from the scrap already in Europe.”

However, as is often in life, what looks simple on paper can be challenging in practice. Products must be redesigned to allow component reuse, new materials development, and better recycling strategy implementation. Moreover, while Europe’s recycling industry is moving towards a circular model, it still faces a relatively low overall recycling rate of 46%, although it’s steadily increasing.

The Challenges of Recycling Aluminium

Before recycling, the scrap must undergo a sorting process to detect the potential impurities in the metal, including elements like iron, silicon, copper, and magnesium. The key challenge for European aluminium recyclers lies in consistently producing aluminium of high quality and purity. Only those recyclers capable of efficiently processing the material and consistently delivering a high-quality aluminium product can successfully market it to end customers.

In the seminar, the SALEMA project discussed its prototype of high-tech sensors and scanners for scrap aluminium. As scrap is fed on a conveyor belt, these sensors and scanners can collect information about its size, shape and chemical composition. This information is then processed by AI to predict the object’s characteristics or raw material category. Robots can then sort the scrap pieces into different categories.

Finding alternatives will also prove vital. Reducing weight is a goal of the Fatigue4Light project. The teams are developing new tests and simulation methods to estimate the fatigue life of vehicle chassis components and select optimal materials. The team studied the mechanical and environmental performance of different types of steel, aluminium and various hybrid materials. For Lucia Barbu, Assistant Research Professor at CIMNE, the International Center For Numerical Methods In Engineering:

“I would say a hybrid component that involves aluminium was best in terms of weight saving. We managed to reduce the weight of the component by about 40%.”

Such radical transformation of the aluminium industry will not be cheap or easy. Existing sorting technologies and infrastructure must be improved, while new ones must be developed. The main challenge will be sorting the aluminium scrap so that the desired aluminium quality can be achieved through recycling. This task is made even more complex by each application and each producer requiring different aluminium alloys.

The Opportunity of Nanoparticle Alloys

Fortunately recycled aluminium can also take advantage of nanoparticle alloys with higher strength and stiffness. This is the purpose of the FLAMINGo project. According to project representative Alvise Bianchin of MBN Nanomateriala,

“FLAMINGo aims to provide the automotive industry with a wider portfolio of sustainable materials,” “By using nanoparticles, we can enhance the strength of alloys, reducing the use of other critical raw materials.”

The dynamic synergy between two transformative sectors—the electric vehicle and aluminium recycling industries—charts a course toward a greener, cleaner, and more sustainable future. Christian Leroy, of European Aluminium, believes

“There are opportunities in the automotive sector especially, but we need to stay innovative. And I guess these projects show some good ideas and some routes to become more innovative for aluminium.”

As Europe steers its focus towards recycling in response to the growth of the EV market, the continent has the opportunity to reduce its carbon footprint and over-reliance on critical resource imports. The commitment to crafting premium materials and products not only trims costs for businesses and consumers but also emphasises a more eco-conscious approach.

![Image [Best of 2025] Power Moves in the Energy World](/wp-content/uploads/sites/3/energy-320x213.jpg)

![Image [Best of 2025] How Generative AI Is Transforming Industry](/wp-content/uploads/sites/3/AI-4-320x213.jpg)

![Image [BUYING GUIDE] How to Choose the Right Industrial Robot?](/wp-content/uploads/sites/3/Industrial-Robot-320x213.jpg)